How To Pay for Memory Care

“How to pay for memory care?” and “Which memory care community is best for my loved one?” are two of the most important questions families seek answers to when a loved one has memory needs. We are here to help you learn about the various payment options so you can put a plan in place that helps you move confidently with financial planning.

We will explore the various public and private ways families cover the cost of memory care so your loved one can enjoy a stimulating and vibrant life in an environment that is both supportive and safe.

Often, we see that our families combine a number of payment options to arrive at the total needed. They tell us it is helpful to have an outline of options so they can discuss the best path forward. In this article we will explore in helpful detail the following options:

- Medicare & Medicaid

- Social Security

- Retirement Account Withdrawals

- Veteran Benefits

- Selling a Home

- Senior Living Bridge Loans

- Employee Health Benefits

Medicare & Medicaid

“Does Medicare or Medicaid pay for memory care?” is likely among your first questions. Medicare is the federal health insurance program for seniors 65+ or those younger with certain medical conditions or disabilities. Many families are surprised to learn that Medicare does not pay for the monthly service fees in a memory care community. However, Medicare will cover the ongoing medical healthcare needs such as hospital care, short-term skilled nursing care, doctor’s visits, and durable medical equipment. As a loved one moves into a memory care community, consulting with a Medicare expert in your community that knows the local and state laws on what coverage is possible is a critical first step to budgeting for the cost of memory care.

Medicaid is a long-term care payment program jointly administered and covered by states and the Federal Government. Most often memory care communities are paid for privately. To qualify for Medicaid, one must demonstrate a need for skilled nursing care and little to no assets. Because Medicaid is administered by states in part, what it will cover for long-term care varies widely by state.

Social Security

Many seniors receive some social security on a monthly basis. While Social Security Income may not be able to pay for the entire stay, it can be an important contributor to the overall amount needed to cover the cost of memory care.

Retirement Account Withdrawals or Sale of Securities

Families and seniors often use their well-earned savings to cover the cost of memory care as well. There are many different types of retirement accounts, such as traditional IRAs, Roth IRAs, 401(k)s, and more. Your loved one may own more than one type of retirement account. As a first step, take time to inventory all your loved one’s retirement accounts.

Often, especially if there is a crisis with a loved one, you may be tempted to make immediate withdrawals and deal with the tax issues later. It is important that you speak with a tax advisor first before liquidating or withdrawing any securities from these accounts because once liquidated it is hard to undo the potential tax implications.

There is a helpful blog series on each retirement account and their potential consequences done by Second Act, a company that specializes in financing options for senior living.

Veterans Benefits:

Many seniors are Veterans or spouses of veterans, just like you. Thankfully, generous benefits for Veterans are available to help you pay for memory care.

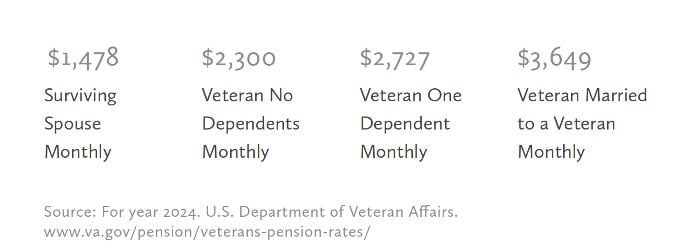

The Veterans Aid and Attendance Benefit is a monthly, tax-free pension that is available to qualifying wartime Veterans and their spouses who need assistance with the Activities of Daily Living or ADLs as they are called in senior living communities. The benefit is designed to help offset your monthly expenses so that you can stay in care with less financial stress. The benefit amounts are adjusted annually for inflation, but they currently range from $1,478 to $3,649.

The application process for Aid and Attendance is long and complex, therefore, many potential candidates rely on third parties to help them apply for their benefits. We often hear from our seniors that assistance with the application gave them the best chance for approval.

If you or your loved one is a wartime Veteran or spouse of a wartime Veteran, contact our communities to learn more about how this important benefit today can help you cover the cost of memory care.

Home Equity: Maximizing Home Sale Proceeds

Your home is one of your most valuable and treasured assets. Many seniors moving into a memory care community use the proceeds from their home sale to pay for dementia care.

Many families decide to hold onto their home and rent it, using the monthly rent income to help pay for the monthly service fees in their memory care community. If renting is not the preferred path, selling one’s home can provide you with the cash you need to pay for memory care.

To get the highest and best sales price for your home it’s important you consider the following helpful steps. Our Cascade Living community professionals can connect you to real estate agents who can spring into action on your behalf so you can focus on your move to our memory care communities while the agents work hard on your behalf:

- A clean, well-staged home commands a higher price: Think of the feeling you get when you walk into a friend’s clean home. You just feel better, don’t you? The same goes for potential home buyers. A sparkling feeling creates excitement and potential! Combine it with well-spaced-out furniture thoughtfully staged, and buyers will begin to feel the value.

- Professional photographs of your home are critical to your home sale success: Today’s home buyers start online. They look at pictures and make a decision in seconds on whether that is a home they want to visit. A beautifully pictured home invites them to come by and tour.

- Cut out clutter, increase spaciousness: We often say that for a home buyer to buy a home there must be enough space for them to visualize their “stuff” in it, from their furniture to their artwork, a good real estate agent will ensure there is a feeling of “spaciousness” during tours.

- Make Repairs to avoid surprises at buyer inspection: Walk through the home with a knowledgeable inspector or contractor prior to listing it so you can know if any repairs are needed. It is always best to

Senior Living Bridge Loans

Sometimes, you may want to move into your memory care community first and sell your home after you have settled into life in your new community because trying to do it all at once may feel like a lot to tackle. Many seniors and families search for ways to pay for senior living and care before they have sold their home and cashed out their home equity.

There is an answer: A home equity line of credit for senior living such as the one offered by Second Act Financial Services which can act as a bridge loan to ease the financial transition into your memory care community. Senior living bridge loans serve as a helpful financial bridge to help you pay for the cost of memory care now while you take the time you need to properly and thoughtfully liquidate other assets.

Here is how bridge financing works:

- Apply for an overall line of credit amount.

- Draw what you need each month to cover the monthly service fees in your memory care community.

- Make much smaller more affordable interest-only monthly payments on your outstanding balance.

- Pay back your line of credit when you have sold your home.

- With this loan the home equity serves as collateral so adult children do not have to co-sign on the loan as borrowers.

Whether you decide to pursue a Second Act Home Equity Line of Credit, or similar financing through your local bank or credit union, know that senior living bridge loans are an often-used financial tool by thousands of families nationwide to pay for memory care and senior living.

Long-Term Care Insurance

Your loved one may have purchased a long-term care insurance policy years or decades ago. When moving to a memory care community the benefits may be activated. Be sure to ask, or look for documents in your loved one’s files, for any evidence of an existing long-term care insurance policy.

Long-term care insurance usually can cover a maximum daily amount for housing and care of a senior living resident. Typically, a resident must demonstrate they need assistance with a certain minimum set of Activities of Daily Living to qualify for their claim.

Filing a claim to receive the maximum benefits possible can be tricky. Your loved one’s long-term care insurance policy is rather long and detailed. Insurance companies may not share your full eligibility or may not realize your full eligibility. Working with knowledgeable professionals specializing in filing claims can save you hundreds of hours of phone and email time. If you have a long-term care insurance policy you would like to use to pay for memory care and aren’t sure where to start, our Cascade Living community professionals can connect you to resources that can help you with filing your claim.

Life Insurance: Selling a Policy Via a “Life Settlement” or Surrendering a Policy for Cash Value

Many families do not realize that as you explore your senior living options, your life insurance policy is an asset that you may be able to sell for cash you can use to cover the cost of memory care.

We often obtain a life insurance policy when we are still working, so if the unexpected happens, spouses or children still at home aren’t saddled with existing mortgages or other obligations.

But as your circumstances evolve, you may no longer need or want to continue paying the premiums on your policy.

If your loved one has life insurance they no longer need, and you would like to explore if it could be sold to help pay for memory care, let our community professionals know. They can connect you to companies that provide Life Settlements.

Another option is simply surrendering a policy for its cash value if selling it is not an option. To find out if this is a viable option the best course of action would be to contact your life insurance policy directly.

Employee Health Benefits

When moving a loved one to memory care or other senior living, you may not think of your employer as someone that could be helpful., but don’t overlook this possibility. Your employer may have a hotline for Geriatric Care Managers who can help you organize an action plan for your loved one’s memory care needs. They may also offer guidance on what may be available through the Family Medical Leave Act (FMLA) if you need a short break to tend to your loved one’s transition to senior living while having the peace of mind that your job is safe. Other employers may offer access to a hotline of counselors who understand aging and memory care for you to speak with. Larger employers especially, typically offer senior living employee benefits to help you as you help your loved one. We find that families don’t think of their employer as a possible resource, but benefits may be available. Even if it is just a hotline to speak with someone that understands the memory care landscape, such a conversation can help you map out a course of action that could save you valuable time and searching.

Memory care communities are designed to help your loved ones thrive throughout a life journey that challenges their mind and are staffed by professionals who understand the progression of memory diseases such as Alzheimer’s or Dementia. You will be pleasantly surprised to discover your loved one is thriving thanks to a supportive environment catering to their social, health, and wellness needs. We encourage you to visit one of our communities so you can see for yourself how we can help your loved one live life to their fullest.